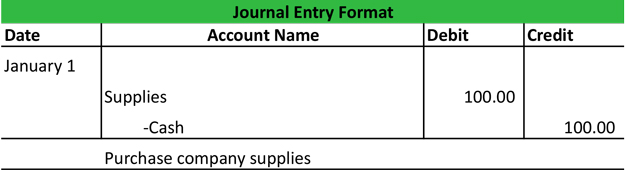

For example suppose a business purchases supplies such as paper towels cleaning products and other consumables for a total. Office supplies used journal entry Overview.

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

In the first entry.

. Purchasing equipment is only one type of transaction that typically receives a journal entry so to get a broader view of the different types of journal entries that could appear on your balance. To show this journal entry use four accounts. First to record the purchase of supplies on credit.

When supplies are purchased they are recorded by debiting supplies and crediting cash. Thus consuming supplies converts the supplies asset into an expense. For example if a business purchases supplies of pens and stationery for 400 the journal entry.

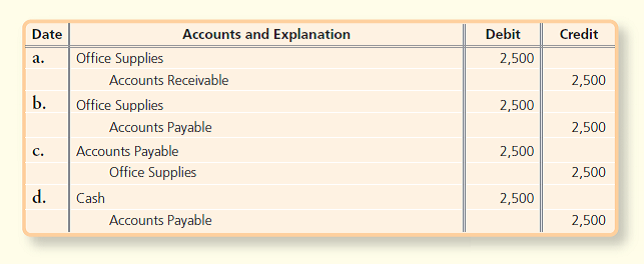

In accounting the company usually records the office supplies bought in as the asset as they are not being used yet. Lets say you sell your asset and end up making money. Company ABC purchased Office supplies costing 2500 and paid in cash.

Paid Cash for Supplies Journal Entry Example. Gain on Asset Disposal. Upon payment of goods purchased in Cash cash balance reduces therefore the asset account is credited according to the Rules of Debit and Credit.

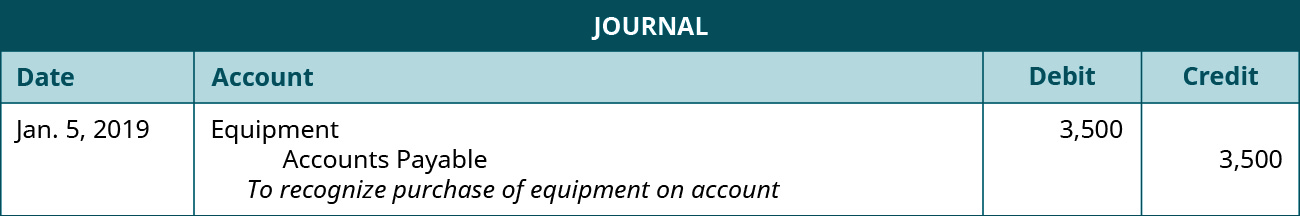

Purchased Equipment on Account Journal Entry. The following Journal entries occurred in 2019 SAS invested 100000 in cash in the Purchased 3000 of office supplies in Purchased equipment for 20000 paying 15000 in cash and the rest. Purchase Office Supplies on Account Accounting Equation.

When the company purchases equipment the accountant records it into the balance sheet under fixed assets section. In this journal entry the office supplies. Adjusting Entry at the End of Accounting.

What journal entry will pass in the books of accounts to record the purchase of goods on credit and payment of cash against the purchase of those goods. Prepare a journal entry to record this transaction. Accounts Payable Supply.

When merchandise purchased for cash are returned to the supplier it is necessary to make two journal entries. So Cash Ac would be credited as a. They also record the.

The journal entry is given below. Journal Entry DebitCredit Equipment 150000 n. Only later did the.

Purchase Of Office Supplies Journal Entry. Second to record the return of supplies. Return of Merchandise Purchased for Cash.

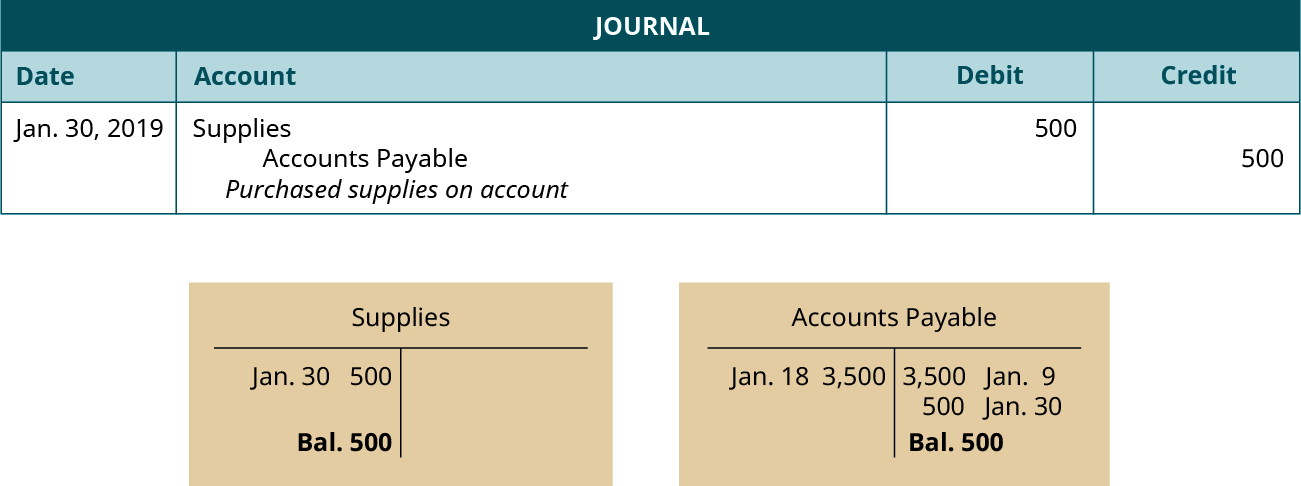

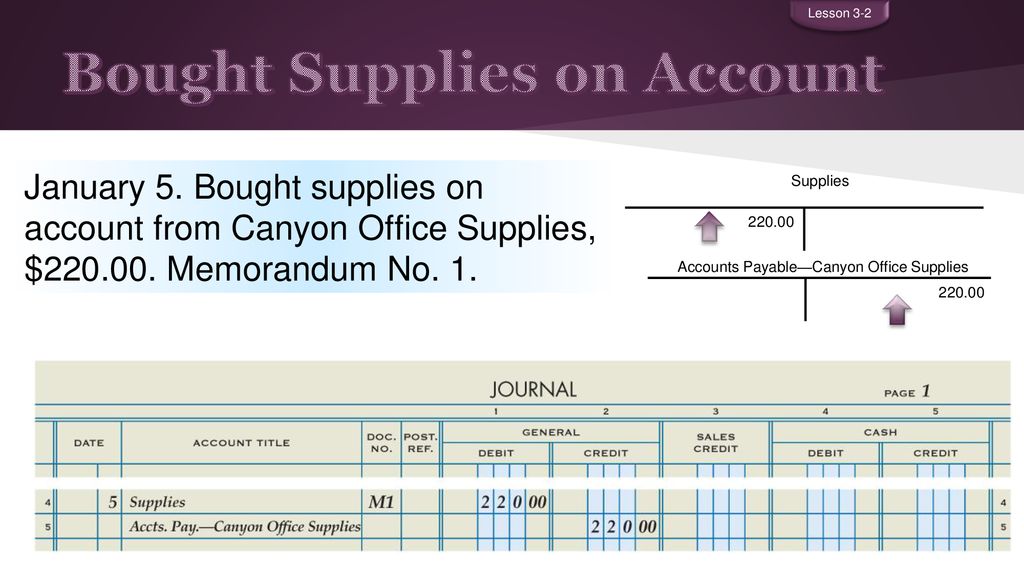

The company can make the journal entry for the bought supplies on credit by debiting the office supplies account and crediting the accounts payable. When supplies are purchased they are recorded in the supplies on hand account. Solution On 1 st July 2019 when.

The accounting equation Assets Liabilities Owners Equity means that the total assets of the business are. The company purchased supplies which are assets to the. Accounting Resource Outline https1drvmsusAp8mLpFX7uo9qXzwZ7cocs0n1NKoeMf19SdFinancial Accounting.

Of course the office supplies would be already debited at the date of the purchase with the credit of accounts payable when the company made a credit purchase. Accounts Payable Supply Company 185000. Paid cash for supplies.

Despite the temptation to record supplies as an asset it is generally much easier to record supplies as. Q1 The entity purchased new equipment and paid 150000 in cash. On January 30 2019 purchases supplies on account for 500 payment due within three months.

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Recording Purchase Of Office Supplies Journal Entry

Purchase Office Supplies On Account Double Entry Bookkeeping

Chapter Journal Review Ppt Download

Answered Accounts And Explanation Debit Date Bartleby

Answered Date Accounts And Explanation Debit Bartleby

Business Events Transaction Journal Entry Format My Accounting Course

Recording Purchase Of Office Supplies On Account Journal Entry

0 comments

Post a Comment